How to Tell If Your Product Is Working: A Startup Metrics Checklist

Do you remember the first sketch of your product? Or that brainstorming session, where your idea was first born? The late-night coding, heated debates about features, and the launch-day adrenaline? You’ve poured your heart, soul, and likely a good chunk of your budget into building something you believe in.

But now it’s out in the wild, and you’re faced with the most critical question of all: Is it actually working?

It’s a deceptively simple question. Without the right guidance and metrics, it’s easy to get lost in a sea of opinions, vanity metrics, and well-meaning but sometimes misleading advice. Your download numbers may

look great, but no one is sticking around. Or perhaps a feature you built as an afterthought is the one thing users keep mentioning.

We often fear failing when launching a new product; however, for many companies, the biggest risk is failing to understand why you’re failing, or worse, not seeing success hiding in plain sight.

The good news is that you don’t have to rely on guesswork and assumptions. There are key startup metrics that define your product’s health and help you make data-driven decisions. Use this article as your guide to cut through the noise and focus on metrics that help early-stage startups, as well as established brands, when launching a new product.

Content

Let’s face the difficult truth: 2025 research shows that 90% of startups fail (10% of them within the first year). The reasons vary from budget issues to market misalignment, but a significant underlying cause is simply this: they build products that people don’t want, or they don’t know how to measure the desire that is even there. They mistake activity for progress and noise for signals.

In 2025, it’s not enough to have enough monthly active users or a feature-rich launch. Your product must fit the market, and with that, customer retention becomes easier—the market pulls your product actively.

So, how do you know if you’re on the right track? Let’s explore some of the indicators of success:

Let’s explore one of the most famous cases of a successful, simple MVP—Dropbox. In its early stages, Dropbox didn’t have a fully built product with all its sync-engine features. They started with a simple minimum viable product. It was a 3-minute video demo, showing how Dropbox would work, focusing on the core value proposition: file synchronization across devices.

They measured the success and observed:

Dropbox measured the right thing at the right time. They didn’t focus on, “Can we build it?” but instead focused on, “Should we build it?”

Before we introduce you to specific startup metrics, we need to define a framework to make sense of them all. Without this guide, you’re just staring at a dashboard of numbers. In this section, we will discuss the difference between leading and lagging indicators.

Lagging indicators are outcome metrics. They tell you the final result of your product launch (did you win or lose). These metrics are historical and can’t be changed. They’re excellent for reporting performance, but terrible for guiding it:

Leading indicators are progress metrics. They’re predictive and actionable, and measure the key activities and behaviors that drive future outcomes. These metrics and the information they deliver allow you to make adjustments in real time.

If you only focus on lagging indicators, you won’t have enough information to move forward. And if you only focus on leading indicators, you’ll miss key metrics that come with product launch. The ultimate goal is to find a golden ratio for your startup: the direct, high-leverage connection between your most critical leading and lagging indicators.

Tracking everything is as useless as tracking nothing. The key is to focus on the metrics that tell you a specific story about your progress. However, a product has several stages of evolution, and each stage requires attention.

| Business Stage & Goal | Category | Key Performance Indicators (KPIs) | Why It Matters at This Stage |

| Launch & Awareness Goal: Generate buzz and acquire initial users. | Acquisition | Website Traffic, Bounce Rate | Measures top-of-funnel reach and initial content/page relevance. |

| Customer Acquisition Cost (CAC) | Validates the cost-effectiveness of your initial marketing channels. | ||

| Engagement | Session Duration, Number of Sessions per User | Indicates whether early users are exploring the product and finding it engaging. | |

| Activation & Validation Goal: Ensure users find core value and stick around. | Engagement | Activation Rate Active User Percentage (DAU/MAU) | The most critical signal: are users experiencing the “aha!” moment and returning? |

| Retention | Client Retention Rate Churn Rate | Answers the fundamental question: “Are we building something people want enough to come back to?” | |

| Satisfaction | Customer Satisfaction Score (CSAT) | Provides immediate, transactional feedback on the user experience. | |

| Growth & Scaling Goal: Drive sustainable, profitable growth. | Revenue | Monthly Recurring Revenue (MRR) Profit Margin | Tracks the financial heartbeat of the business and its path to profitability. |

| Health | Customer Lifetime Value (LTV) LTV to CAC Ratio | The ultimate test of scalability. Ensures the cost to acquire a customer is worth their long-term value. | |

| Loyalty | Net Promoter Score (NPS) | Measures word-of-mouth potential and long-term customer loyalty, which fuels efficient growth. |

Let’s follow each stage and explore the essential KPIs, including financial metrics, annual recurring revenue, gross profit, and other buzzwords we often use when measuring the success of a new product launch.

This is the initial take-off of your product. At this stage, you should not expect immediate profit, but focus on generating buzz and validating that there’s a market for your solution. Acquire your first set of users and test your initial marketing strategies and value proposition to see what resonates.

This is the total number of visitors to your website or landing page. It’s the rawest measure of awareness and the effectiveness of your initial marketing push.

The percentage of visitors who land on your page and leave without taking any action (like clicking a link or scrolling). A low bounce rate is great. However, a high bounce rate often indicates that your messaging, targeting, or product doesn’t resonate with the audience you’re trying to attract.

This is a key financial metric that calculates the average cost it takes to get one paying customer.

Formula: Total marketing + sales spend / number of new customers acquired.

In the launch stage, you’re determining if your pricing strategy and marketing strategies can efficiently attract a new customer without burning through your cash.

Now that you have visitors, you need to ensure they become engaged users. At this stage, you need to prove that your users don’t just sign up, but actually use your product and find core value.

We also call this a “Stickiness Ration,” because it measures engagement frequency. This KPI shows how many users are active on a daily basis (the percentage). A high ratio indicates your product is valuable enough for the users to incorporate it into their daily or weekly routines.

This metric uses a specific method—typically a short survey after a key interaction—to gauge user happiness on a scale (e.g., 1-5). Startups use this metric to acquire immediate feedback on the user experience. This KPI is one of the most significant measurement elements to use, since it helps you pinpoint friction points and fix them.

This tracks the percentage of users who remain active over a specific period (e.g., a month or a quarter). You’ll know you’re delivering a valuable solution if the retention rate is high.

“Investors want to see excellent retention because SaaS is all about keeping customers in the long run.”

Christoph Janz, Point 9, 5 Metrics that Matter When Raising Your SaaS

Churn rate shows the percentage of customers who cancel or stop using your product within a specific period. This is one of the most essential of startup metrics. If the churn is high, you have a “leaky bucket,” and you need to investigate why users are leaving and turn things around.

If you’ve passed stages one and two successfully, you’ve validated that users love and stick around with your product. Now, it’s time to focus on building a sustainable and profitable business. At this stage, you’ll be optimizing your financial engine, scaling your efficient marketing channels, and forecasting long-term success.

MRR is a predictable monthly revenue that startups expect to receive on a monthly basis. It’s the lifeblood of a subscription-based startup. Tracking MRR growth (including the Compounded monthly growth rate – CMGR) is essential for forecasting and valuation.

This KPI measures what percentage of your revenue has turned into profit after accounting for all operational costs. It moves beyond top-line revenue to answer, “Are we actually making money?”

Customer lifetime value is the total revenue you can expect to earn from an average customer over the entire interaction with your product. This metric can help you understand the long-term value of your customer base.

LTV to CAC ratio is an essential metric for scalability. It compares the lifetime value of a customer to the cost of acquiring them. A ratio of 3:1 or higher indicates a healthy, scalable business model where your customers are worth significantly more than what you spend to get them.

With so many metrics to track, it’s easy for startup founders to feel overwhelmed. Your goal shouldn’t be tracking everything, but focusing on the right things. Below, you’ll find an actionable plan to select the metrics that deliver valuable insights and drive real business growth.

Don’t measure everything at once and focus on what matters the most. Often, we recommend our clients to measure only one metric, at least at first, and change the key metrics strategy later, if necessary.

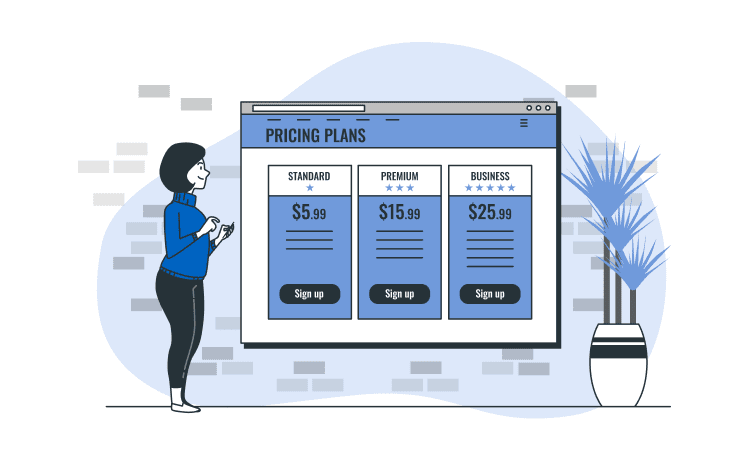

The “right” metrics depend heavily on how you make money. There is no one-size-fits-all approach when it comes to tracking the success of your product.

Since the lagging indicator tells you what happened, and a leading indicator highlights what to do next, this step is a strategic measurement. It helps you report the past and influence the future.

Don’t fall into the “analysis paralysis.” Track metrics that matter. The goal is to have the clearest line of sight to the actions that drive business growth.

Let’s explore a case study of an MVP mobile app for health-conscious individuals, and see how you can use different metrics and change strategies as it evolves through each stage of growth.

| Stage | Product Focus & Key Question | Key Leading Indicators (The Levers) | Key Lagging Indicators (The Outcomes) | Primary Action / Strategy |

| 1. Launch & Awareness | MVP: A simple app that creates a weekly meal plan based on dietary goals. Question: Are we solving a real problem for health-conscious individuals? | Sign-up Rate from a waitlist Bounce Rate on the landing page App Store Page Views | Total Waitlist Sign-ups Customer Acquisition Cost (CAC) from initial ads | Generate Buzz & Learn. Use a pre-launch waitlist and targeted social media ads to gauge interest. Ignore revenue; focus on validating that the core concept attracts users. |

| 2. Activation & Validation | Product: Users can generate plans and get a shopping list. Question: Do users experience the “aha!” moment and stick around? | Activation Rate (user generates their first plan) W1 Retention Rate CSAT on meal plan quality | W4 Retention Rate User Churn Rate | Optimize Onboarding. A/B test the onboarding flow to maximize the Activation Rate. Use qualitative feedback (CSAT) to rapidly improve the AI’s meal suggestions. |

| 3. Growth & Scaling | Product: Integrates with grocery delivery services for one-click ordering. Question: Is our business model scalable and efficient? | W1 Retention Rate % of Users Using “Auto-Order” Net Promoter Score (NPS) | Monthly Recurring Revenue (MRR) LTV:CAC Ratio Burn Rate | Drive Profitable Growth. Focus marketing on channels that yield a strong LTV:CAC ratio. The leading indicator “% of Users Using Auto-Order” is the biggest predictor of long-term retention and revenue. |

| 4. Optimization & Maturity | Product: Advanced features like family plans and nutritional reports. Question: How can we maximize value from our existing customer base? | Expansion MRR Rate (from plan upgrades) Feature Adoption for new family plans Customer Effort Score (CES) | Net Revenue Retention (NRR) Net Profit Gross Margin | Maximize Efficiency & Profit. Shift focus from new customer acquisition to increasing revenue per user (Expansion MRR) and improving operational efficiency to boost Net Profit and Gross Margin. A NRR > 100% is the ultimate goal. |

Seeing your metrics clearly requires the right technical setup. You may have the perfect strategy, but if your data is scattered or if you lack real-time visibility, you’ll fall into “analysis paralysis” anyway.

Your product needs to be properly “instrumented” from day one. You should invest in robust analytics and tracking platforms, such as Mixpanel (excellent for event-based tracking and cohort analysis, perfect for activation and feature adoption) and Amplitude (designed for product analytics and user journey mapping).

For a free baseline on web traffic, Google Analytics 4 is essential for measuring your top-of-funnel reach (Traffic, Bounce Rate). Finally, specialized Metrics Dashboards like Baremetrics or ChartMogul are invaluable for SaaS businesses, as they automatically calculate and visualize recurring revenue metrics like MRR, churn, and LTV, allowing you to focus on growth, not spreadsheets.

If you feel overwhelmed by all the different metrics, various categories, and numbers you need to track, you’re not alone. It’s essential to know when to get professional help. Sometimes, the overwhelm isn’t just about having too many metrics; it’s about a fundamental disconnect between your product, your data, and your strategy.

This is often the case when:

Partnering with an experienced product development team can be a game-changer. Glorium Technologies, for example, has over 15 years of expertise in complex industries like healthcare, real estate, manufacturing, and others, helping startups take their first steps, develop MVPs, validate ideas, and grow and scale.

Explore our case studies to see how we help build a strong foundation for future scaling. For example, our client was able to gather information about product-market fit and the desire for their solution with our working prototype for NFT and SFT campaigns in three to four months.

Need strategic framework implementation and expert interpretation of your metrics? Book an intro call with our experts.

Traffic is growing, but revenue isn’t? You may be dealing with a “leaky bucket.” You’re acquiring users, which is good, but they aren’t converting or sticking around. This means that you need to shift your focus from top-of-the-funnel metrics to middle-of-funnel metrics (from traffic to activation rate and retention rate).

It depends on the metric itself. Leading indicators need to be checked weekly to make quick adjustments. Lagging indicators can do well on a monthly check.

Absolutely. We can help you establish the framework from day one, identify your stage, define that OMTM, and ensure your MVP is technically instrumented to track the right leading and lagging indicators from launch. Take a look at our case studies to see our frameworks in action.

Yes. This is a common scenario we see with some of our clients. To fix this issue, we need to conduct a product and metrics audit to identify where the leaks are in your funnel. After the analysis, we can help you prioritize a roadmap of improvements.

The Pirate Metrics, also known as AARRR, is a popular and straightforward framework for categorizing product-focused KPIs. It provides a clean, sequential way to view the user journey. Our three-stage framework (Launch & Awareness; Activation & Validation; Growth & Scaling) covers the first four AARRR stages directly. The ‘Referral’ part (word-of-mouth growth) is primarily measured by the Net Promoter Score (NPS) in our Growth & Scaling stage, and the Revenue metrics are foundational to that third stage. The AARRR framework is an excellent complementary model to help your team think about the entire funnel of user value.