Business Central vs Finance and Operations in Real-World ERP Scenarios

Picking an ERP is a lot like buying a car. If you just focus on a long list of fancy features without considering where you’re actually going to be driving, you may end up with something that doesn’t fit your life.

Business Central is like a reliable SUV, perfect for daily commutes and regional trips. It gets the job done without the extra bulk. Dynamics 365 Finance and Operations, on the other hand, is a heavy-duty semi-truck built for global routes and massive loads. You would neither buy a semi to run errands around town, nor would you use a compact car to move industrial freight.

Content

Almost 75% of ERP strategies don’t really match how the business runs, which often leaves teams confused and wondering why the system isn’t delivering the results they expected. Poor system fit (don’t confuse it with technology limitations) is often the main culprit of underperformance. This challenge is especially evident within the Microsoft ecosystem when you make the Dynamics 365 Business Central to Finance and Operations comparison.

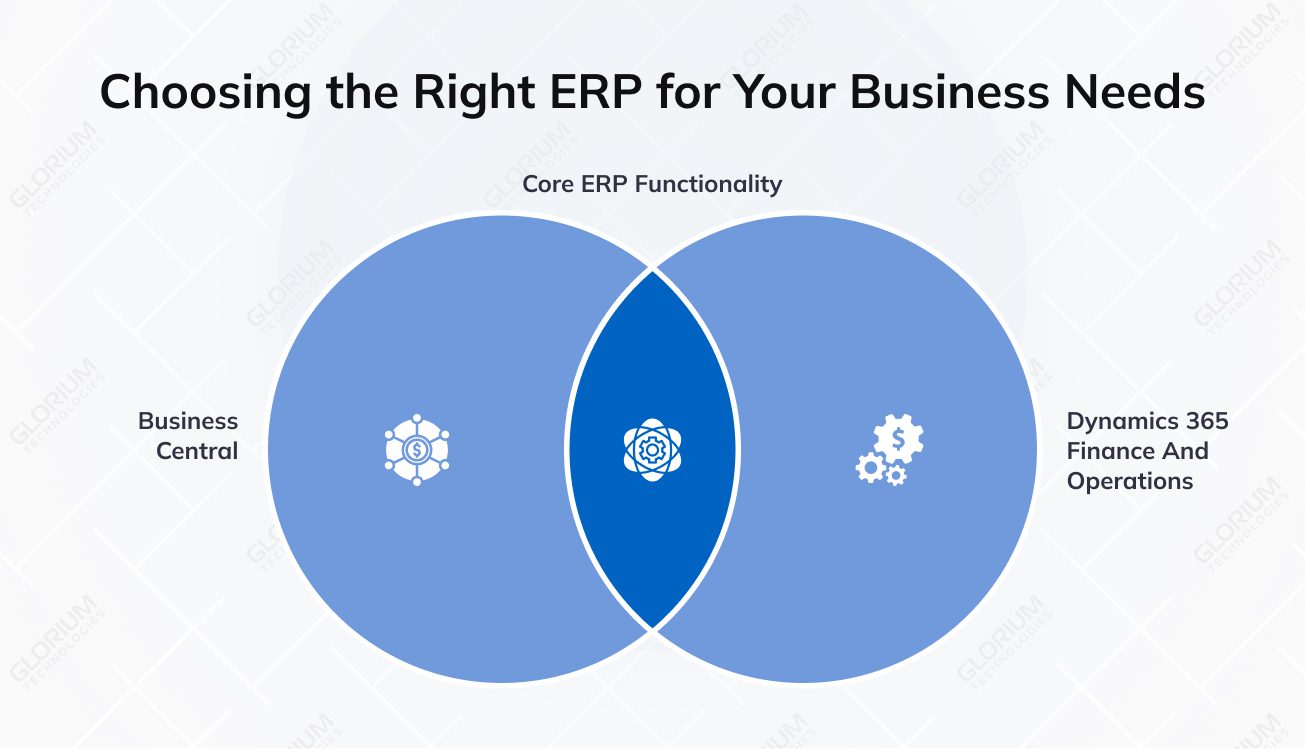

On paper, both ERP systems cover finance, supply chain, reporting, and integrations. In practice, they are designed for very different levels of organizational complexity. Feature overlap can mask fundamental differences in scale tolerance and governance depth.

That’s why ‘real-world ERP scenarios’ are not theoretical use cases or idealized workflows. They reflect everyday operational pressure:

If you’re the one balancing the budget, keeping operations tight, and trying to drive growth—whether you’re the CFO, COO, or IT lead—picking the wrong ERP is a massive risk. For you, the gap between D365 Business Central vs Finance and Operations is about whether your team can actually keep up with reporting and planning as things get more complicated.

Whether you choose one over the other, enterprise resource planning software comes down to a choice between agility and depth. While both systems were designed under the Microsoft umbrella, they cater to different market segments.

Business Central is an all-in-one solution for small to medium-sized businesses interested in rapid modernization. In contrast, Dynamics 365 Finance & Operations is a modular, enterprise-grade powerhouse designed to handle the massive transaction volumes and complex global hierarchies of multinational corporations. Not quite the same thing, isn’t it?

Business Central is a boon for those seeking an accessible ERP platform with minimal overhead. It encompasses finance, inventory management, sales, supply chain management, basic project management, and customer interactions. The typical operational footprint includes around 10 to 500 users, limited sites, and moderately complex workflows that closely follow existing processes. It might be your go-to option if you want visibility across finance and operations with minimal ongoing maintenance.

Business Central delivers strong value through relatively quick, yet always scenario-based implementation (typically 2 to 6 months) and a familiar Microsoft 365 interface. Lower implementation costs, simpler configuration, and faster user adoption make it a cost-effective solution for organizations working within budget constraints and planning steady growth.

This ERP solution is built for large enterprises with complex, high-volume transactions. Its scope supports advanced financial management, multi-currency accounting, advanced supply chain management, and governance across global operations.

The platform serves enterprises with 500+ users operating across multiple countries, currencies, legal entities, and global supply chains. It supports intricate parent-subsidiary relationships and global consolidation.

Dynamics 365 F&O is suited to international companies managing complex processes, regulatory demands, and large-scale operations.

Deeper controls become necessary when you face complex operational requirements like:

Is the complexity you’re dealing with a ‘natural’ result of growth or a ‘barrier’ to your business efficiency? Business Central is a powerhouse for mid-market agility, boasting 265% ROI over three years for typical SMBs. Nonetheless, Finance & Operations is non-negotiable when handling high-volume, multi-national data. The following scenarios illustrate the practical ‘breaking points’ where the key differences between these two platforms become visible.

For mid-sized businesses, operations often start within a single legal entity, a limited number of sites, and straightforward approval paths. If it feels like your case, MD 365 Business Central makes for a good fit. It supports essential business processes across finance, inventory, sales, and projects without the overhead of enterprise-grade architecture. You can stick to the ERP software as long as your team can manage tasks without heavy intercompany logic. However, once your company expands into a multi-entity structure, the administrative burden shifts. of different environments or using basic ‘Intercompany Inbox’ features to swap journal entries. When your business reaches a point where intercompany transactions (centralized purchasing or global resource sharing) become a daily, high-volume requirement, you can encounter practical limits.

Microsoft Dynamics 365 Finance and Operations, aka Dynamics 365 Finance, is built for large enterprises that need to manage hundreds of legal entities under a single ‘Global Address Book.’ It supports consolidation and elimination processes when configured; eliminations require defined rules, mapping, and governance, but still remove the operational complexity that causes smaller systems to buckle.

For an SMB, accounting usually comes down to a general ledger and basic AP and AR. Business Central supports this setup well, giving small finance teams a solid framework that keeps decision-making fast and uncomplicated.

But as your business grows, you start hitting complex financial hurdles that a standard setup just can’t clear. We’re talking about advanced financial management needs like multi-currency accounting, tracking, or reporting in local GAAP and corporate IFRS at the same time. When your audit prep needs to be airtight, and your month-end close needs to be lightning-fast, F&O gives you the advanced capabilities to enforce ‘fiscal period closes’ at the sub-ledger level. For the public sector or highly regulated fields, that extra layer of control moves from nice-to-have to mission-critical.

If your business follows a standard buy-sell model, you can streamline business processes easily with BC’s native inventory tools. It handles bin tracking and assembly orders with ease.

The ‘aha!’ moment for moving to F&O happens when your already-complex supply chain gets messy, and order volume becomes high like never before. You need a warehouse management system with mobile device integration and sophisticated demand forecasting.

While BC users often have to bolt on third-party solutions to get advanced features, F&O includes them right out of the box. Its ‘Master Planning’ engine can crunch through numerous requirements across your global warehouses in a jiffy, ensuring operational efficiency stays high even when your SKU count explodes.

The choice comes down to what’s happening on the shop floor in manufacturing. Business Central is well-suited for assembly-to-order scenarios or simple production processes that don’t change frequently. It manages BOMs, routings, and stable production schedules.

On the flip side, Microsoft Dynamics 365 Finance (specifically the Supply Chain Management module) is designed for complex scenarios. If you’re doing process manufacturing with formulas and co-products, or discrete manufacturing with massive capacity constraints, you need the manufacturing capabilities that F&O brings to the table. It helps you manage tasks like job sequencing and real-time labor tracking that would simply overwhelm a smaller system.

There’s the question of how you want to handle growth. Business Central allows businesses to add new features quickly through ‘Apps’ in the Microsoft AppSource. It’s great for staying agile, but if you’re not careful, you can end up with a ‘Frankenstein’ system of too many third-party solutions. Plus, relying heavily on extensions may increase dependency on vendors and complicate upgrades.

F&O is designed for a complex implementation where the code itself is often customized to fit organization-specific workflows. This does mean you’ll need more extensive training and a bigger IT budget, but you get a comprehensive suite of tools that are truly native. For those with existing systems that must be tied into the ERP via high-frequency API calls, F&O’s enterprise-grade backbone is just more resilient.

Microsoft Dynamics 365 Business Central vs Finance and Operations

| Features | Business Central | F&O |

| Ideal Company Size | Growing mid-market and SMB companies | Large global enterprises |

| Entity Management | Manual switching between entities | Unified Global Address Book |

| Financial Depth | General ledger and AP/AR | Multi-ledger, dual GAAP, and IFRS |

| Governance & Audit | Flexible month-end decision making | Enforced sub-ledger hard closes |

| Inventory & WMS | Basic bin and assembly tracking | Native mobile WMS and forecasting |

| Planning Engine | Standard demand and supply tools | High-volume Master Planning engine |

| Shop Floor Control | BOMs and routings | Real-time labor and job sequencing |

| Customization | Low-code apps via AppSource | Deep code-level workflow customization |

| System Backbone | Agile, extension-based architecture | Resilient, high-frequency API integration |

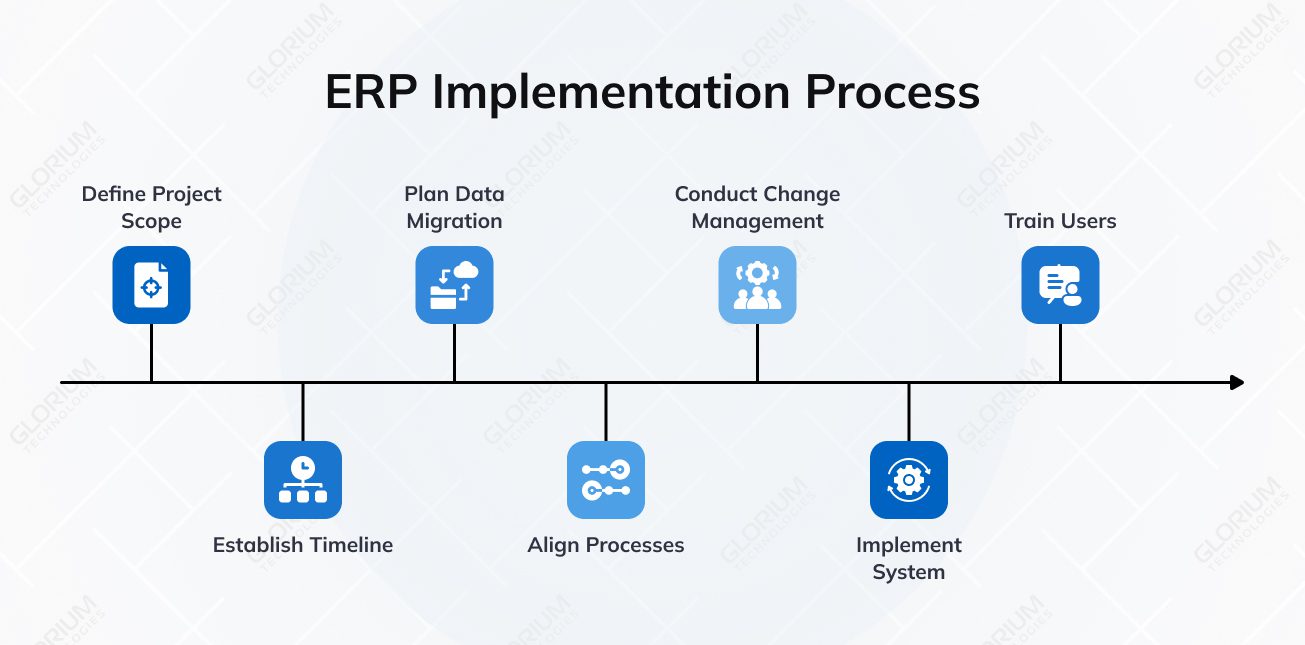

Implementation isn’t just about installing the right ERP system; it’s more about reshaping how you work, how you make big decisions, and how your team interacts with data every single day.

If you can get a clear picture of what’s coming—before you lock in timelines or start clicking buttons—you’ll have a much easier time avoiding scope creep. To help you prepare, we’ve broken down the practical realities that most teams face when implementing these systems.

Think of Business Central as the ‘sprint’ of the ERP world. Rollouts are typically lean, involving a small internal task force and a partner focusing on professional services to get you live in months.

On the other hand, Finance & Operations is more like a marathon. It requires a dedicated project management office and heavy involvement from every department. For larger organizations, project governance is much stricter because the system’s capabilities are so vast that missing a single configuration can ripple across a hundred legal entities.

The migration path in BC is about following multiple approaches (migration tools, configuration packages, APIs, partner tools) to shift your records over. There are fewer entities, simpler data models, and closer alignment to existing processes. However, you shouldn’t underestimate the cost considerations of cleaning up messy legacy (financial and inventory) data before importing it.

F&O takes this to another level. Migration here involves complex operations where data must be mapped across global dimensions and multiple currencies. The biggest risk? To underestimate the time needed for User Acceptance Testing. F&O offers advanced capabilities, but those only work if your data mapping is flawless.

Since Business Central offers a familiar Microsoft 365 feel, role-based training is a no-brainer, but still needed to avoid posting errors and ensure consistent processes. Most users can manage tasks after just a few sessions.

Dynamics 365 Finance & Operations calls for more extensive training and much deeper technical knowledge to navigate its menus. To mitigate adoption risks, many teams lean on business intelligence tools and the Power Platform to create simplified ‘role-based’ views. This way, you get the advanced functionality of the engine without making every employee feel like they need a pilot’s license to use it.

Software is only half the solution; the other half is the team that helps you switch it on. As an official Microsoft partner with 15+ years of experience leading digital transformations, we help small to large businesses get the ideal solution. Our ERP-devoted team is here to align your software with your long-term growth plans.

If you can’t decide between Dynamics 365 Finance and Operations vs Business Central, we can walk you through how each system’s analytics capabilities will perform under your specific workload. If you are ready to modernize, contact us today.

Even though the world is moving to the cloud, on-premises deployment remains plan B for companies with strict data residency laws or unreliable internet. It gives you total control over your hardware and update schedule, though it places more responsibility on your team for updates and infrastructure. Plus, you’ll miss out on real-time AI features and need a robust IT team.

It comes down to how much data you’re crunching and who needs to see it. Business Central is great for standard Power BI reports, but if you need enterprise-grade analytics capabilities to spot trends across hundreds of global entities, F&O is the winner. It handles massive datasets and AI-driven forecasting that would simply overwhelm a mid-market system.

The short answer is – when simple job costing no longer cuts it for your business needs. If you’re juggling complex, multi-layered service contracts or need to track granular profitability across thousands of global assets, service management in F&O is the heavy hitter you need. F&O handles intricate intercompany allocations that would break a simpler system.