Odoo Statistics 2026: Market Position, Company Size, and Data-Backed Insights

The global enterprise resource planning sector in 2025 transitioned from monolithic, rigid architectures to fluid, intelligence-driven ecosystems. At the forefront of this evolution stands Odoo, the Walloon-born unicorn that has successfully disrupted the mid-market and small-to-medium enterprise (SME) segments. In 2026, Odoo’s trajectory is characterized by aggressive revenue acceleration, a massive expansion of its human capital, and a shift toward agentic artificial intelligence.

For IT decision-makers and investors, data is the only currency that matters. This report aggregates 65+ verified statistics regarding Odoo market share, the broader ERP market, and implementation benchmarks for 2026. Here are all the essential ERP and Odoo statistics you should not miss in 2026!

Content

Odoo’s performance in 2025 and projections for 2026 confirm its position as a dominant player in the global ERP market. Far from its origins as a niche project, the company has solidified its status as a “Walloon unicorn”, executing a deliberate strategy to capture a larger share of the mid-market and SME sectors. Odoo continues securing large-scale contracts with multinational corporations.

The platform provides a versatile ecosystem that accommodates a wide range of business needs. Odoo offers everything from free community editions to top-tier enterprise solutions. While small businesses frequently implement Odoo as an out-of-the-box solution, its extensive customization capabilities allow it to compete directly with legacy ERP providers.

Key Odoo market & adoption statistics:

“We’ve focused on creating packages for new industries, but also on improving existing ones so that these sectors have the perfect tool. Odoo is a game-changer by covering the specific needs of each profession at an affordable price.”

Key ERP market size & growth statistics:

The competitive domain of 2026 features a distinct divide between legacy giants and agile disruptors. Odoo stands as the primary disruptor, particularly for SMEs and mid-market firms seeking to avoid vendor lock-in and high total cost of ownership (TCO).

Here is a quick overview of Odoo vs. other top ERP software by market share.

| Vendor | 2025 Market Share | 2024 Market Share | YoY Change |

| Oracle NetSuite | 28% | 26% | +2 pp |

| SAP (S/4HANA + B1) | 24% | 25% | -1 pp |

| Microsoft Dynamics | 18% | 17% | +1 pp |

| Infor | 8% | 8% | 0 pp |

| Epicor | 5% | 5% | 0 pp |

| Others (including Odoo) | 17% | 19% | -2 pp |

Here is a quick overview of Odoo vs. other top ERP software, highlighting key characteristics.

| Architecture & Modularity | Moderate, with increasing extensibility | High, enabled through SuiteApps | High, powered by the Power Platform | Very high, based on open-source modular architecture |

| Primary Industry Focus | Retail, finance, manufacturing, with expanding AI-driven retail solutions | E-commerce, professional services, software, and related sectors | Broad, with strong adoption among SMBs | SMEs, services, retail, and eCommerce |

| Deployment Options | On-premise or cloud | Cloud-only | On-premise or cloud | On-premise or cloud |

| Innovation & AI Capabilities | High, including Joule AI Copilot and industry-specific cloud tools | Moderate, with SuiteAnalytics and AI integrations | High, featuring Copilot and AI-driven workflow automation | High, with PWA support, mobile-first UI, and simplified UX |

| Typical Implementation Timeline | Moderate to long, ranging from months to years | Moderate, typically weeks to months | Moderate, typically weeks to months | Short, usually days to weeks |

Here is a quick overview of Odoo vs. other top ERP software in terms of companies’ usage.

| ERP Platform | Companies Using the ERP |

| Odoo ERP | Toyota; Del Monte Quality; Santafixie; Qatar Investment Authority; WWF; Sodexo; Scarpetta Shoes; Sock Club; Cobuild Lab; Bazile Telecom; KOGLAND Commerce Pvt Ltd; Allnex |

| SAP S/4HANA ERP | Apple; Microsoft; IBM; Coca-Cola; Walmart; Bosch; Intel |

| Oracle NetSuite ERP | Accelerator Learning; Lovesac; Corkcicle; Beekman 1802; Pandora Jewelry; Lucky Brand Jeans; PetShop; Flexport; OmniTRAX; Transavia; HK Express |

| Microsoft Dynamics 365 ERP | Macy’s; Under Armour; Mattress Firm; Aditya Birla Fashion & Retail; BESTSELLER; Hitachi; Nissan; Ford Motor Company |

Here is a quick overview of Odoo vs. other top ERP software on pricing.

| ERP Platform | Starting License Cost (Per User/Month) | Implementation Range | Best For |

| Odoo ERP (Standard) | $7.25 – $9.10 | $5,000 – $50,000 | Fast-growing SMEs |

| Odoo ERP (Custom) | $24.90–$37.40 | $15,000 – $150,000 | Mid-market & Multi-company |

| Oracle NetSuite ERP | $99–$125 | $10K – $100K+ | Global finance-heavy firms |

| SAP S/4HANA ERP | $100–$250+ | $75K – $500K+ | Large multinationals |

| Microsoft Dynamics 365 ERP | $80 – $110 | $35K+ | Microsoft-centric ecosystems |

A Quick Summary of the Key Takeaways for Companies Planning ERP Implementation

While the demand for ERP systems is at an all-time high, the complexity of implementation remains a significant hurdle. So, here are the key takeaways for companies planning an ERP implementation into business processes:

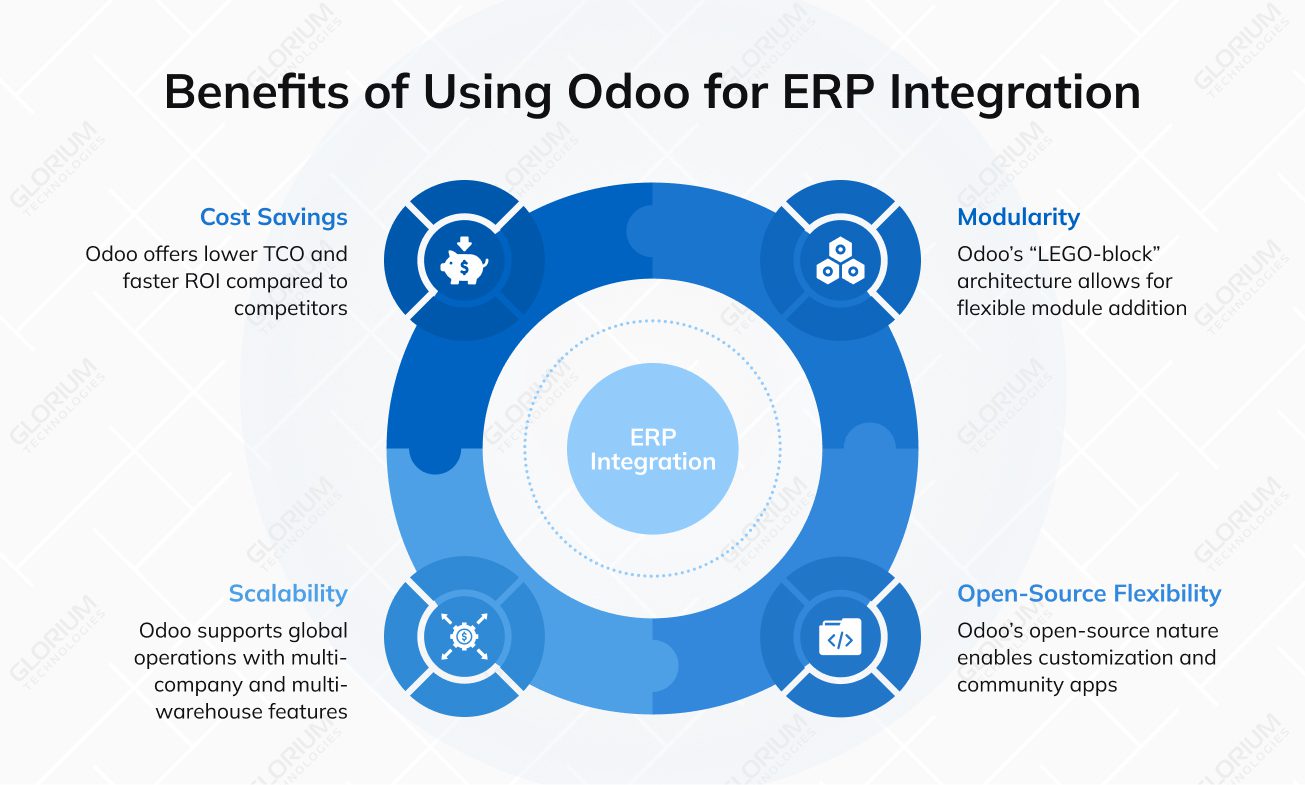

Modern business management requires a level of agility that traditional ERP systems often struggle to provide. While legacy software might handle basic business operations, it often lacks the open-source flexibility needed to keep pace with rapid growth in a volatile market.

Moving to Odoo’s modular, cloud-based apps lets companies scale their entire infrastructure instantly. We see this shift driving massive cost savings because you finally ditch the pricey on-premise hardware and those specialized maintenance teams. With Odoo ERP, you can keep all your business operations, including inventory management, tightly connected in one place.

Glorium Technologies is a Certified Odoo Partner and Microsoft Dynamics 365 Business Central Partner. With 15+ years of excellence and a global footprint spanning the United States, Europe, and the UK, we provide end-to-end Odoo implementation services, including integration of third-party applications, migration from legacy systems or older Odoo versions, and employee training and support.

We welcome you to explore our case studies or book an intro call with our experts to map your Odoo ERP journey.

As of late January 2026, Odoo is serving over 170,000 customers across five continents. Regarding specific implementations, the data indicates a grand total of 191,807 Odoo references (estimated using a multiplier to account for non-publicly listed setups).

The growth rate is particularly high, with Odoo reaching 13,000+ new clients per month as of late 2025. In terms of user density, market penetration is estimated at 133.7 units per 1 million people globally.

Odoo’s dominance is highly visible in specific regions and segments. A small elite group of partners (the top 1%) manages nearly 9.4% of all references, while the top 10% of partners account for 42.2%. With a valuation exceeding €7 billion (and references to an €8 billion valuation in user surveys), Odoo is now among the top 5 private software companies worldwide in its size bracket.

Several factors are accelerating Odoo’s adoption this year:

The 5 top countries by partner count are the United States (250), Saudi Arabia (204), Egypt (176), India (156), and Argentina. Odoo has gained massive credibility in the corporate sector, with 3 of the “Big Four” audit and consulting firms now using the Odoo suite. High adoption is noted in HoReCa (Hotel/Restaurant/Café) through specialized Point of Sale packages.

The data points to a very strong “yes” for several reasons: