How to Do Market Research for a Startup Without Wasting Your Runway

Building a startup in 2025 means operating in a tougher, noisier market than even a few years ago. The latest Global Startup Ecosystem Report notes that the overall ecosystem value has dropped by approximately 31% compared to the previous cycle. At the same time, only a small share of AI-native companies break through as real growth stories. In this environment, “move fast and break things” is expensive: market research becomes the way to de-risk the next release, pitch, or pivot, rather than betting your runway on guesswork.

This article provides a practical guide to conducting market research for a startup without overcomplicating the process. You’ll walk through a step-by-step process for clarifying your research goals, mapping your market and competitors, choosing the right mix of qualitative and quantitative methods, and turning what you learn into concrete product and go-to-market decisions that are grounded in real demand.

Content

Market research is a structured way to answer a few big questions at once: who your real customers are, what they actually need, and whether they will pay you to solve that problem. For a startup, it means shifting from “we think” to “we know.” Instead of guessing, you talk to people, run small surveys and experiments, and combine what you hear with external data. The goal is not a huge report that nobody reads, but clear evidence that guides your next product decision, release, and go-to-market move.

In practice, market research sits right alongside product discovery, UX, analytics, and fundraising. It helps you decide what should go into the MVP, which segment to launch with first, how to position and price your offer, and what kind of proof you can confidently show investors. The wider market is moving in the same direction: recent overviews suggest it has already passed $150 billion in annual value and is on track to exceed $160 billion by the end of 2025, with classic market research accounting for roughly a third of that amount. When companies spend that much just to understand their markets better, it is a clear sign that knowing your users and your landscape is now core infrastructure.

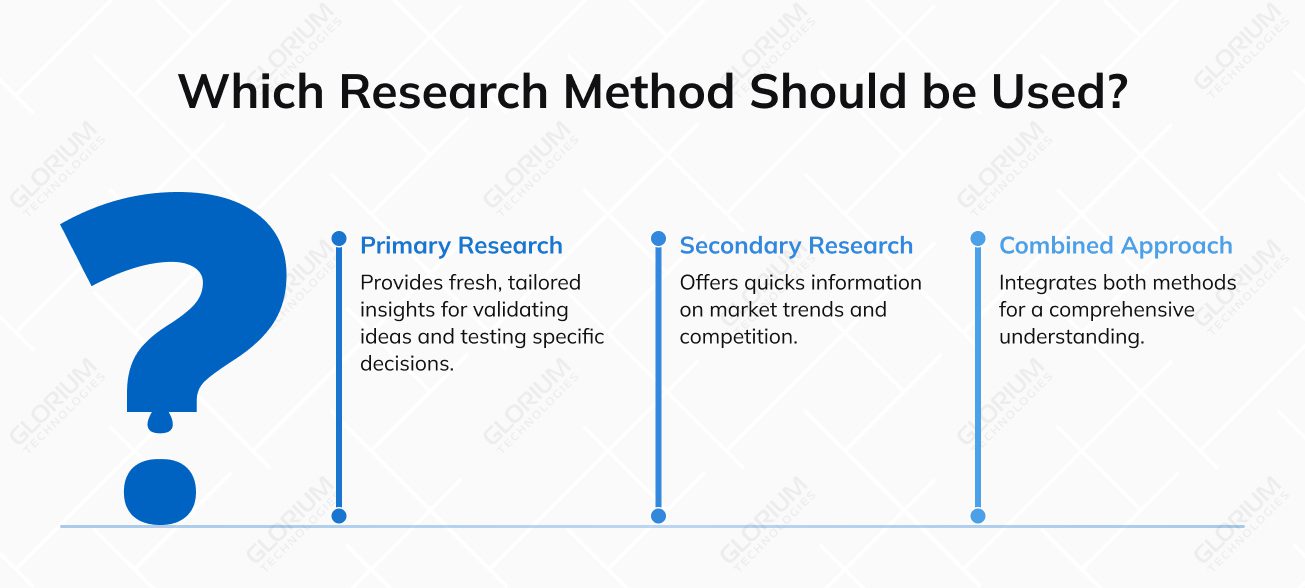

In a startup, you’ll naturally use different ways to learn about your market. What matters is knowing what each method is good for. That way, you don’t spend weeks on interviews when you really need numbers, or bury yourself in reports when you should be talking to real customers.

Primary research is everything you collect directly from your target market. You design the questions, select the participants, and facilitate the conversations. For a startup, this usually means surveys, one-to-one interviews, usability sessions, or small pilot cohorts using your MVP. Because you control the questions, you can go very specific: “How do you currently solve this problem?” “What would make you switch?” “Which pricing model feels fair?”

Primary research is beneficial when validating a startup idea, shaping an MVP, or testing a concrete decision, such as which features to include in the first release. It provides you with fresh, meaningful insights you won’t find in any public report.

“As the old saying goes, talk is cheap, so simply asking someone if they would buy something is completely different than putting that thing in front of them and asking them to hand over their wallet or their credit card or their hard-earned cash actually to make that sale, and this is why you need to not just look at what people say but more importantly what they actually do.”

Adam Erhart, Marketing Strategist

Secondary research utilizes data that’s already available. Instead of asking people directly, you learn from industry reports, public datasets, analyst notes, competitor websites, case studies, review platforms, and sometimes academic or government sources. It won’t answer every niche question, but it will quickly inform you about key factors such as the market’s growth rate, the level of competition, and common complaints from buyers about existing tools.

In practice, startups rarely choose between primary and secondary research; as a rule, they combine them. Early in the journey, you may rely on secondary research to understand the overall landscape, and then use primary research to test whether your specific startup idea has traction with a narrow segment. Later, when you’re optimizing pricing or UX, you’ll keep reading up on key competitors and industry trends while running more targeted online surveys, interviews, and experiments on your own product.

Quantitative research employs methods that generate numerical data for analysis, including structured surveys, product analytics, A/B tests, pricing experiments, and polls. These methods answer questions like “How many?”, “How often?”, and “Which option works better?”. You turn the results into charts and metrics that show demand, price sensitivity, conversion rates, or feature importance across segments.

Qualitative research uses methods that capture depth rather than volume: one-to-one interviews, open-ended survey questions, usability sessions, founder calls, and customer feedback sessions. Instead of counting responses, you’re listening for patterns: how people describe their problems, what motivates them, what they fear, and which hidden objections make them hesitate.

Finally, it helps to look at research through the lens of what you’re trying to decide. The same market research methods can be used very differently depending on the goal. For startups, the most common objectives are:

Doing market research is easier when you break it into clear, simple steps instead of trying to study everything at once. Below is the process we usually follow at Glorium Technologies with early-stage teams, from clarifying goals to turning insights into concrete product and go-to-market decisions.

The first step is to get crystal clear on why you are doing research. At Glorium Technologies, we always start with an introductory call to map your real business questions. Are you trying to validate demand, compare pricing options, or choose the best early adopter segment?

From there, we turn those questions into 2–3 concrete hypotheses. For example: “Marketing managers at mid-sized SaaS companies are willing to pay $X per month” or “Freelancers are more likely than agencies to switch from their current tool.” Clear hypotheses help us decide what data we need and when we have enough evidence to move forward or pivot.

Before we talk to a single user, we spend time getting a comprehensive understanding of the landscape. Our team does structured desk research to map market size, key market trends, and the leading players. We examine direct competitors, substitute solutions, and behavioral patterns.

In parallel, we sketch early personas and buying roles based on what’s already available, including job titles, typical company sizes, use cases, and budget ranges. This secondary research reveals what is already known and identifies areas where gaps exist. Those gaps become the focus of the primary research we run next.

Once the goals and gaps are clear, it’s time to select the appropriate methods. At Glorium Technologies, we rarely rely on a single technique. Instead, we combine a few light-weight methods that match your stage and budget.

For example, to validate demand for an MVP, we might run a short survey plus 10–15 in-depth interviews and a simple landing page test. For pricing questions, we may add more structured questionnaires. The idea is to select the smallest mix of methods that can provide trustworthy answers, without turning a high-quality market research into a six-month project.

This is where the plan becomes concrete. We define who needs to be in the sample: existing users, prospective customers, or cold audiences that match your ideal customer profile. Then we decide how many people we really need to talk to, and in which mix.

Our team writes neutral, non-leading questions and interview guides. We avoid “sales pitch” language and focus on behaviors, pains, and trade-offs. Finally, we plan recruitment and incentives: email lists, panels, social media, communities, or partner databases. The goal is a realistic setup you can actually execute.

When it’s time to gather data, consistency matters more than perfection. In projects we run, every interview follows the same core script, and every survey uses the same logic and scales. That makes results easier to compare later.

We also pay attention to bias. Founders often want to jump in and explain the product; we deliberately separate “discovery” conversations from “demo” calls. All answers, notes, and recordings are organized into a shared structure from the start, so the team is not left to clean up the data at the end.

Raw answers are not enough. At Glorium Technologies, we treat analysis as its own mini-phase. For quantitative data, we clean and segment responses, looking for patterns across groups to identify who is more likely to buy, churn, or switch.

For qualitative data, we code interviews into themes: recurring problems, desired outcomes, phrases people repeat, and objections that block adoption. Then we revisit the initial hypotheses: Which ones are confirmed, which ones are disproved, and which need more evidence? The deliverable is not just charts, but a clear story about what the market is telling you.

Market research only delivers value when it informs your next actions. That’s why our teams always translate good market research findings into informed decisions and experiments.

For the product, this might mean adjusting the MVP scope, reshuffling the roadmap, or dropping a feature nobody cares about. For go-to-market, it could mean changing your core message, targeting more responsive focus groups, or testing a different price point.

Markets change, competitors move, and your product evolves. Launching one research project is not enough. In long-term collaborations, we help clients establish a streamlined research rhythm: conducting a few user interviews each month, administering short surveys following key releases, and periodically reviewing competitors and market signals.

This doesn’t need to be heavy. Even a small, regular market research habit keeps your roadmap grounded in reality and makes future pivots less painful, because you’re always in touch with the market.

“Market research is not an event. It should be a constant methodology followed on a regular cadence. A continuous feedback loop is critical, requiring someone to be accountable for the market research process (such as a Chief Strategy Officer or CMO/VP of Marketing). This ongoing rhythm ensures that marketing strategies remain aligned to existing customers, prospects, employees, and that the organization remains differentiated from competitors.”

Eric Estrella, Client Success Manager at SBI

You don’t need an expensive research stack to get valuable answers. For most early-stage startups, low-cost tools are enough. Google Forms, Typeform, or Tally are suitable options for surveys. Zoom, Google Meet, and Loom are used for conducting interviews and usability tests. Notion, Miro, or a simple Google Sheet can hold your notes, links, and fundamental market analysis. The point is not the tool itself, but using one shared space so insights don’t disappear into random chats and notebooks.

A significant amount of potential for consumer research lies in communities and review sites. Niche Slack groups, Reddit threads, LinkedIn communities, Product Hunt, G2, and Capterra reveal how people discuss problems and tools when no one is pitching them. You can see what they praise, what frustrates them, which features they ignore, and which benefits actually matter. That language feeds directly into your interviews, survey questions, and marketing messaging tests.

To keep things structured, it helps to reuse a few simple templates instead of starting from scratch every time:

These scrappy tactics will provide a steady flow of grounded insights while you are still moving fast and watching every dollar.

Most startups mix both approaches. You handle lightweight, fast discovery in-house and bring in a partner when the questions are high-stakes, complex, or time-sensitive. The primary market research cost drivers are scope (the number of questions and markets), sample (the target audience), and method (simple interviews versus robust surveys and competitive analysis).

A simple rule: do it yourself for early validation and ongoing customer talks; use a partner when a decision will lock in 6–12 months of burn (new market, major rebuild, pricing overhaul) or when investors expect solid, neutral evidence. A good brief keeps partner work efficient: define the decisions you need to make, your hypotheses, target customers, constraints, and how you plan to use the results.

| Aspect | DIY | Research partner |

| Typical use | Early discovery, quick checks, and ongoing customer chats | New markets, pricing changes, major pivots |

| Cost and time | Low expenses, higher founder time | Higher expenses, lower internal time |

| Best stage | Business idea, pre-MVP, early seed | Late seed, Series A+, complex or regulated domains |

| What to handle in-house | Problem discovery, basic surveys, landing page tests, and simple UX sessions | Large samples, hard-to-reach roles, multi-country work, and advanced pricing |

| Main risks | Bias, small sample, results hard to reuse | Over-scoped studies, “pretty deck” with weak links to roadmap |

| How to get value | Use simple templates, document insights, and revisit them every quarter | Give a clear brief, share existing data, ask for decisions, and next experiments |

Many founders want to be more data-driven but get stuck on where to start, how much is “enough,” and how to keep market research moving in parallel with product development. At Glorium Technologies, we are conducting market research to fit the way startups actually operate: fast, focused, and tightly tied to the next few decisions on your roadmap.

We begin by clarifying what you really need to know: for example, which focus group to target first, which use cases matter most, or how potential buyers think about pricing and alternatives. From there, we design a lean research plan centered on those questions, typically a combination of interviews, a targeted survey, and brief desk research on competitors and market context. You stay involved in defining the questions and joining key calls; we handle recruitment, logistics, and analysis, so research does not compete with product work for your team’s time.

Glorium Technologies never treats research as an isolated artifact. In turn, our team translates insights into concrete options: which features to include in the next release, which messages to test, which segments to prioritize, and what experiments to run next. If you later move into MVP development or broader SaaS development services, the same people who ran the research can carry that context into delivery, so none of the nuance gets lost between a report and the codebase.

Ready to stop guessing and start building with real data? Reach out to Glorium Technologies for an intro call, and we’ll map out a lean, step-by-step market research plan that shows exactly what to test, who to talk to, and how to turn those insights into a sharper MVP.

We combine 15+ years of engineering experience with a strong product and research mindset. Instead of treating market research as a separate “reporting” service, we use it to answer your real business questions: who to target first, which problems matter most, how to position against alternatives, and what should go into your next release. We help you frame clear hypotheses, choose the right mix of methods (interviews, surveys, desk research), and turn findings into concrete decisions about roadmap, messaging, and experiments.

We focus on questions that directly impact the product and its go-to-market business strategy. Typical examples are: who the best early adopter segment is; which problems are excruciating and frequent; how buyers describe their workflows and alternatives; which features feel “must-have” versus “nice-to-have”; which pricing model makes sense in your niche; and what differentiates you from existing tools in the minds of real users. If a question changes what you build, how you sell, or how you talk to investors, it’s a good candidate for a research sprint.

We design every project so that each key finding is tied to at least one decision. In practice, that means we don’t just present “insights”; we present trade-offs. For example: “Segment A has stronger urgency but longer sales cycles; Segment B is easier to reach but more price-sensitive.” In the final workshops, we walk you through these trade-offs and document the outcomes as specific actions, such as changes to your roadmap, messaging, targeting, or experiments. That way, research has a visible impact, rather than sitting in a folder.

There’s no fixed “typical” budget, because it depends on your scope, audience, and methods. Most early-stage teams start lean, conducting founder-led interviews, simple surveys, and focused desk research, then invest more only when a decision is made to lock in a serious MVP or go-to-market spend.

First, at Glorium Technologies, we map the landscape, key players, segments, and pricing, then speak with your target buyers to identify genuine gaps and switching triggers. From there, we narrow your ICP, highlight must-have use cases, and translate that into a focused MVP concept and positioning that doesn’t try to “beat everyone,” just to win a clear niche.

With Glorium Technologies, market research is tightly connected to real product delivery. Our team has over 15 years of experience and has delivered more than 150 solutions across healthcare, fintech, real estate, and SaaS, backed by ISO 9001, ISO 27001, and ISO 13485 certifications, as well as HIPAA- and GDPR-ready practices. We have also received recognitions such as Inc. 5000, IAOP Global Outsourcing 100, and Clutch Top 1000. This mix of delivery track record, compliance, and domain depth helps ensure real-world constraints frame your research and turn into clear, realistic product and go-to-market decisions.