The Power of Artificial Intelligence in Health Insurance

In the current era of rapid technological advancements, health insurance finds itself at the forefront of transformative change, largely driven by the seamless integration of artificial intelligence (AI).

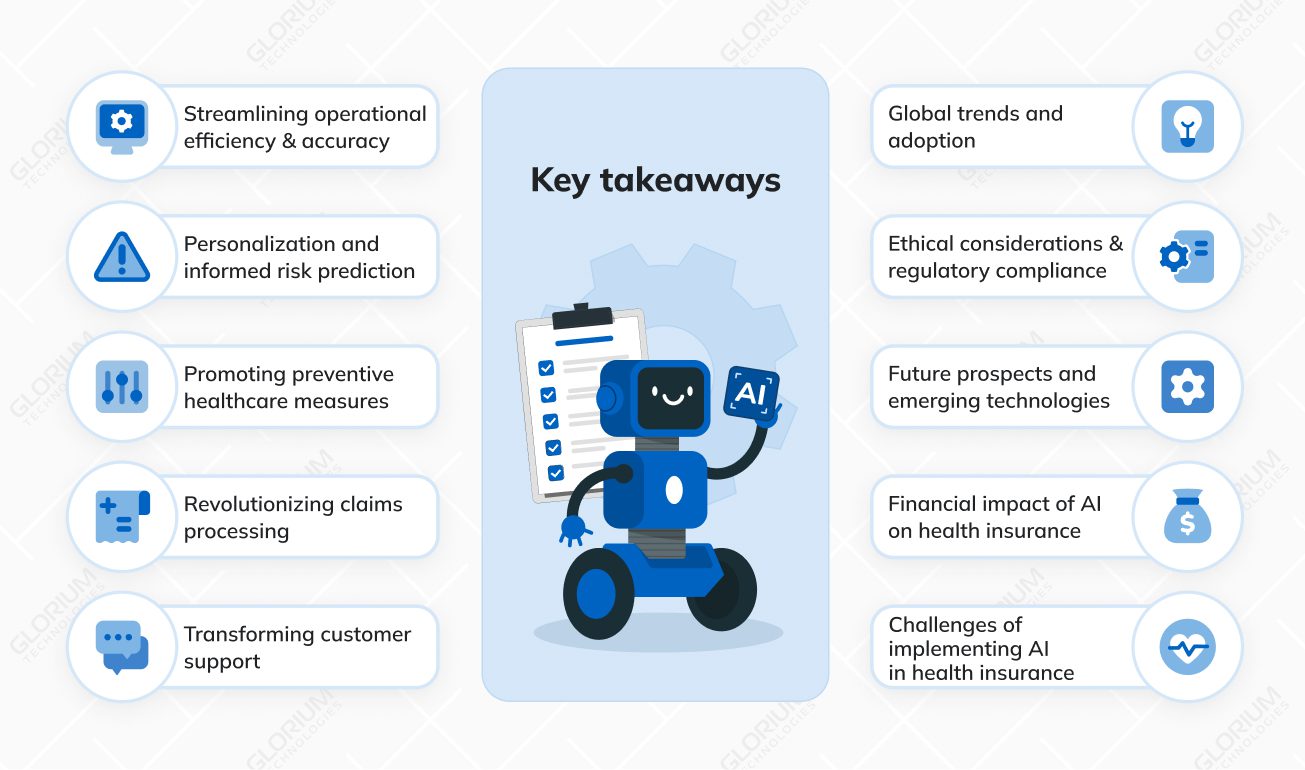

This article aims to go beyond the broad strokes, providing concrete examples that illustrate the tangible impact of AI across various facets of the health insurance landscape. We will also explore the challenges that accompany the implementation of AI-driven solutions, offering insights into the complexities of this transformative journey.

Content

Example: Automated claims processing

One of the most significant impacts of AI in health insurance is its prowess in enhancing operational efficiency and accuracy, vividly exemplified through automated claims processing. Insurers are leveraging advanced AI algorithms to swiftly analyze medical records and associated documentation. This not only expedites the claims process but also minimizes errors, ensuring a seamless experience for both insurers and policyholders.

Automated claims processing systems powered by AI can extract relevant information from medical records, process claims faster, and validate the accuracy of submitted documents. This not only accelerates the reimbursement process for policyholders but also allows insurers to optimize their operational workflows. The result is a more efficient and error-resistant claims processing system, streamlining the entire insurance workflow.

Example: Tailored insurance plans

AI’s ability to analyze vast datasets becomes evident in the realm of risk assessment, leading to the creation of tailored insurance plans. Insurers are increasingly utilizing AI algorithms to delve into individual health data, crafting insurance plans that cater to specific needs. This personalized approach not only ensures better coverage but also facilitates more accurate risk evaluation, benefiting both insurers and policyholders.

Traditional insurance models often rely on generalized risk assessments, leading to suboptimal coverage for some individuals. AI-driven risk prediction models consider a multitude of factors, including lifestyle, genetics, and medical history. This depth of analysis enables insurers to provide personalized insurance plans that align with the unique health profile of each policyholder. This not only enhances customer satisfaction but also allows insurers to manage risks more effectively.

Example: Wearable devices and incentivized wellness

AI’s contribution to promoting preventive healthcare is exemplified through the integration of wearable devices and incentivized wellness programs. Insurers incentivize policyholders to adopt healthier lifestyles by providing discounts based on data from these devices. This proactive approach aligns with the broader trend of preventive wellness, potentially reducing long-term healthcare costs.

Wearable devices, such as fitness trackers and smartwatches, collect real-time health data that can be utilized by AI algorithms. Insurers can use this data to encourage and reward policyholders for adopting healthier behaviors. For example, meeting daily step goals or maintaining a healthy heart rate might result in premium discounts. This not only benefits individuals by promoting healthier habits but also allows insurers to proactively manage and mitigate potential health risks, reducing long-term healthcare costs.

Example: AI-driven fraud detection

Claims processing, often complex and time-consuming, is revolutionized by AI-driven fraud detection. Algorithms can detect anomalous patterns and behaviors, indicating potential fraudulent activities. This not only protects insurers from financial losses but also ensures the integrity of the health insurance system.

Fraudulent claims pose a significant challenge in the insurance industry, leading to substantial financial losses. AI-driven fraud detection systems analyze large datasets to identify patterns indicative of potential fraud. This proactive approach allows insurers to detect and prevent fraudulent activities before they impact the bottom line. By leveraging AI for fraud detection, insurers can enhance the accuracy of claims processing and maintain the trust of policyholders in the integrity of the insurance system.

Example: AI-powered virtual assistants

The transformation of customer support in health insurance is exemplified by the integration of AI-powered virtual assistants. These assistants provide real-time assistance to policyholders, ensuring quicker responses to queries and enhancing the overall customer experience through on-demand support.

AI-powered virtual assistants in health insurance serve as a valuable resource for policyholders seeking information, filing claims, or navigating complex insurance processes. These virtual assistants can understand natural language, provide personalized responses, and guide policyholders through various insurance-related tasks. The result is a more responsive and efficient customer support system that enhances the overall experience for policyholders, fostering satisfaction and loyalty.

Beyond specific applications, the global adoption of AI within the health insurance landscape is illustrated by international collaborations. Countries worldwide are embracing AI technologies, showcasing a global shift towards more efficient, accessible, and adaptive health insurance solutions.

The adoption of AI in health insurance is not limited to individual regions; it is a global phenomenon. Countries around the world recognize the potential of AI to revolutionize healthcare and insurance, leading to collaborative efforts to share knowledge and advancements. These international collaborations facilitate the exchange of best practices, accelerate innovation, and contribute to the development of standardized AI solutions that can be applied globally. The result is a collective effort to harness the full potential of AI in health insurance on a worldwide scale.

Ethical considerations and regulatory compliance are crucial aspects of AI implementation in health insurance. Transparent AI decision-making becomes a key focal point for insurers navigating the responsible use of AI. This includes ensuring transparency, accountability, and adherence to regulatory frameworks, emphasizing fair and equitable health insurance practices.

As AI algorithms make complex decisions that impact individuals’ lives, transparency becomes essential. Insurers must provide clear explanations of how AI arrives at specific outcomes, especially in deep learning models where decision-making processes may seem opaque. This transparency builds trust among policyholders and regulators, reinforcing the ethical use of AI in health insurance. Additionally, adherence to regulatory standards such as HIPAA and GDPR is paramount, ensuring that AI applications comply with legal and ethical requirements for the protection of sensitive health information.

Peering into the future, the integration of emerging technologies such as predictive analytics takes center stage. These innovations, exemplified by early disease detection models, showcase the continuous improvements and advancements that make AI an integral driver of progress within the health insurance industry.

Predictive analytics powered by AI holds the promise of early disease detection, enabling insurers to proactively identify health risks and intervene at an early stage. By analyzing diverse data sources, including individual health records and lifestyle data, AI algorithms can identify patterns indicative of potential health issues.

Early detection allows insurers to implement preventive measures, potentially reducing the severity of illnesses and associated healthcare costs. The integration of predictive analytics signifies a paradigm shift towards a more proactive and preventive approach to healthcare within the health insurance industry.

The financial impact of AI in health insurance is not just theoretical; it’s quantifiable. According to a McKinsey report, AI adoption in healthcare could generate $100 billion in annual savings by 2025. IBM Watson Health estimates that AI can reduce administrative costs by up to 50%. These figures underscore not only technological advancements but also the tangible financial benefits that AI brings to the health insurance landscape.

The financial implications of AI in health insurance extend beyond operational efficiency. The adoption of AI-driven solutions translates into significant cost savings for insurers.

Automated processes, accurate risk assessments, and fraud detection contribute to streamlined operations and reduced administrative overhead. As a result, insurers can allocate resources more efficiently, optimize costs, and potentially pass on the financial benefits to policyholders in the form of competitive premiums. The quantifiable financial impact reinforces the business case for embracing AI in health insurance as a strategic investment.

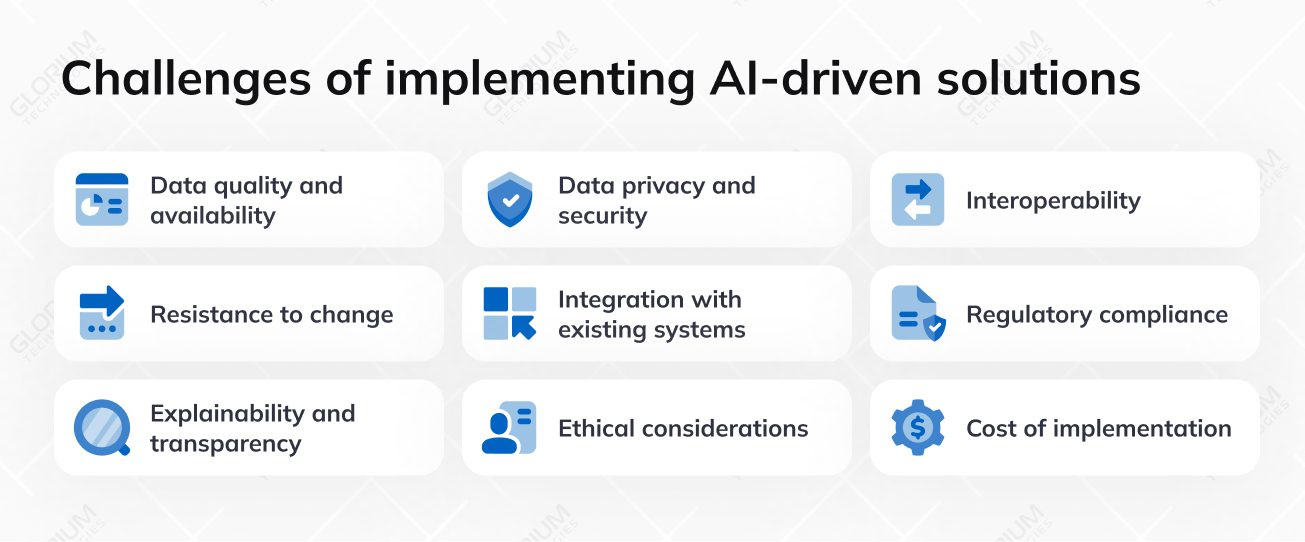

The implementation of AI-driven solutions in health insurance is not without its set of challenges. Each challenge poses unique considerations that organizations must address to ensure successful implementation.

From data quality and privacy to regulatory compliance and user acceptance, navigating these complexities requires strategic planning and innovative solutions.

Ensuring that the data used by AI algorithms is accurate, consistent, and relevant. Poor-quality or inconsistent data can hinder the effectiveness of AI applications.

Practical insight: Implement data validation processes and invest in data cleansing tools to enhance data quality. Collaborate with healthcare providers to establish standardized data formats.

Addressing concerns related to the protection of sensitive healthcare data. Compliance with regulations like HIPAA and GDPR is crucial to avoid breaches and maintain the privacy of patient information.

Practical insight: Implement robust encryption methods, conduct regular security audits, and educate staff on data protection protocols. Develop strict access controls to prevent unauthorized data access.

Achieving seamless communication and compatibility among diverse platforms and technologies used in health insurance systems. Ensuring that different systems can work together cohesively.

Practical insight: Invest in interoperable technologies, promote industry-wide standards, and foster collaborations between stakeholders to streamline data exchange.

Overcoming reluctance from employees and stakeholders to adopt AI-driven solutions. This resistance can stem from fear of job displacement, lack of understanding, or skepticism about the technology.

Practical insight: Develop comprehensive training programs, communicate the benefits of AI to staff, and involve employees in the implementation process to alleviate fears and build a culture of innovation.

Incorporating AI into existing health insurance systems, often legacy systems, without disrupting operations. Ensuring compatibility and a smooth transition are significant challenges.

Practical insight: Conduct thorough system assessments, gradually introduce AI components, and invest in middleware solutions to facilitate smooth integration with existing infrastructure.

Adhering to healthcare regulations and insurance industry standards, such as HIPAA and GDPR. Navigating complex compliance requirements to ensure legal and ethical use of AI.

Practical insight: Establish a dedicated compliance team, stay updated on regulatory changes, and implement automated compliance monitoring tools to ensure adherence to evolving standards.

Ensuring that AI algorithms, especially deep learning models, can provide clear explanations for their decisions. Transparency is crucial for building trust and understanding how AI arrives at specific outcomes.

Practical insight: Use interpretable AI models, provide transparent documentation on algorithms, and educate end-users about how AI contributes to decision-making to enhance understanding and trust.

Addressing potential ethical concerns related to bias, fairness, and the responsible use of technology. Ensuring that AI applications adhere to ethical standards and do not contribute to discriminatory practices.

Practical insight: Implement bias detection tools, conduct regular audits of AI models, and involve ethicists in the development process to ensure fairness and responsible use.

Balancing the significant investment required for implementing AI solutions, including technology, training, and infrastructure, with the long-term benefits. Managing costs can be particularly challenging for smaller organizations.

Practical insight: Conduct a thorough cost-benefit analysis, explore government grants and partnerships, and consider phased implementation to manage costs effectively.

When venturing into an AI-backed health insurance project, selecting the right development team is paramount for success. Look for a team that not only possesses expertise in both AI and health insurance but also boasts a proven track record in crafting solutions tailored to the intricacies of the healthcare sector.

Prioritize those with a keen focus on data security and compliance with regulations like HIPAA, ensuring the confidentiality and integrity of sensitive health information. Opt for a team that values innovation, stays updated on the latest trends, and demonstrates adaptability to keep your project at the forefront of technological advancements.

Effective communication is equally vital, so choose a team that fosters collaborative and transparent interactions, providing you with regular updates and a clear understanding of project goals. With the right blend of experience, innovation, and communication, your AI-backed health insurance project is poised for success!

Anton KumechkoProject Manager, Glorium Technologies

The successful implementation of AI-driven solutions in health insurance relies heavily on choosing a trusted software development company. Here are key considerations to guide you in selecting the right partner:

Look for a software development company with a proven track record in developing AI solutions for the healthcare and insurance industry. Experience in the specific domain ensures a deeper understanding of industry nuances and compliance requirements.

Assess the technical expertise of the development team, particularly in AI, machine learning, and data security. A skilled team is crucial for developing robust and effective AI-driven solutions that meet the unique challenges of health insurance.

Request and verify client references to gauge the company’s reputation and past project success. Client testimonials and case studies provide insights into the company’s ability to deliver on its promises.

Ensure that the software development company has a strong commitment to regulatory compliance, including adherence to healthcare standards such as HIPAA. Compliance is non-negotiable when dealing with sensitive health data.

Choose a company that maintains transparency in its development processes. Clear communication, regular updates, and collaborative project management contribute to a successful partnership.

Prioritize companies with robust security protocols in place. Data security is paramount in health insurance, and the development partner should demonstrate a commitment to safeguarding sensitive information.

Opt for a company that demonstrates a commitment to innovation. The healthcare landscape is dynamic, and an innovative development partner can bring fresh perspectives and cutting-edge solutions to the table.

At Glorium Technologies, we take pride in being at the forefront of innovation, specializing in the development of AI-driven web and mobile applications for the Healthcare and Insurance industries. With a dedicated team of experts, we bring a wealth of experience and technical prowess to the table, aiming to revolutionize the way health insurance operates in the digital age.

Our proficiency in building advanced AI solutions enables us to address the unique challenges faced by the healthcare and insurance sectors. From streamlining operational workflows to ensuring the highest standards of data security and privacy, we tailor our AI applications to meet the specific needs of our clients in these critical industries.

As health insurance embraces the era of AI, the transformative potential becomes increasingly evident. The examples provided showcase how AI is reshaping the landscape, offering efficiency, personalization, and financial benefits. However, acknowledging and addressing the challenges is crucial for unlocking the full potential of AI in health insurance. In navigating this transformative journey, a balanced approach that considers both opportunities and challenges will pave the way for a future where AI enhances the health insurance experience for all stakeholders.

As the industry continues to evolve, the synergy between human expertise and AI-driven innovations will shape a healthcare ecosystem that is not only efficient but also empathetic, ensuring the well-being of individuals and the sustainability of the health insurance landscape on a global scale.